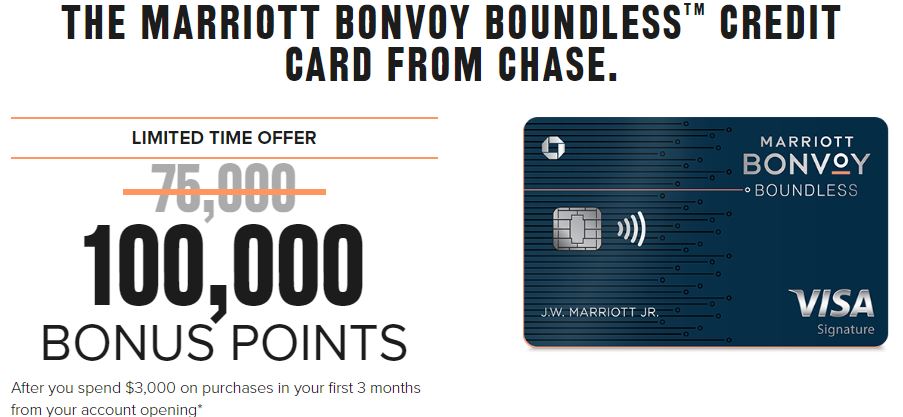

If you have been reading the blogs, you would know that Chase has a special limited time offer on the Bonvoy Boundless card. Under this limited time offer, you can earn 100,000 bonus points (instead of the usual 75,000 points) when you spend $3,000 on purchases in your first 3 months from your account opening. The annual fee of $95 is not waived. This is a great deal if you have Marriott stays planned – 100,000 points is certainly a nice bonus.

Personally, I only stay at Marriott hotels sporadically (like next weekend when I’ll be visiting my dad), so I haven’t applied for this card. I used to have the SPG Business American Express but gave it up some time ago when many of the benefits, such as free lounge access, were removed.

BUT HOLD ON A SECOND!!!!!

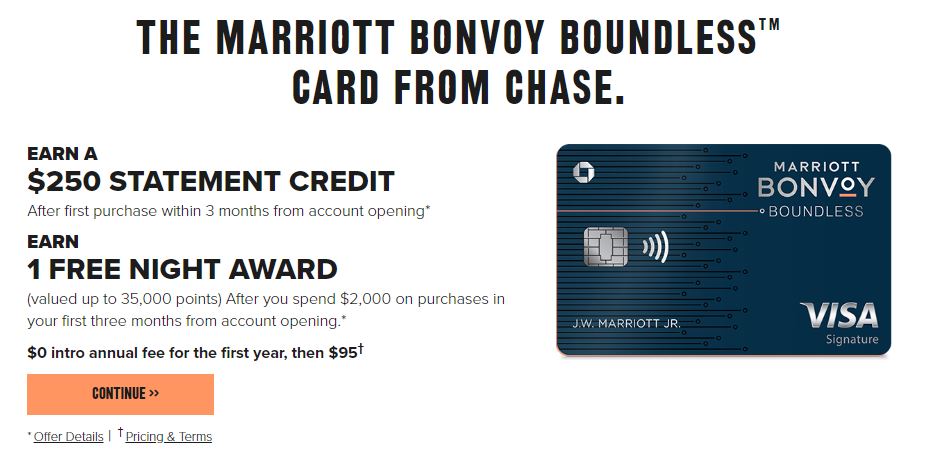

I was on the Marriott website looking to make a reservation at a hotel in Massachusetts and this offer popped up on the screen:

This is an amazing deal! Make any purchase on the card, and receive a $250 statement credit! Plus, if you spend $2,000 in the first three months, you’ll receive a free night (35,000 points) award. Lastly, unlike the 100,000 point offer above, the $95 annual fee is waived for the first year.

To me, this is a win win!!! I’m applying!

I do not have a link for this offer and I will not receive referral credit if you apply. Simply go to the Marriott website and start making a reservation and see if this offer appears.

Have a great weekend!

A New York frequent flyer who elegantly combines her passions for worldwide travel, running a gazillion marathons all over the globe and staying fit ... without sacrificing her fancy for good wine and food.

A New York frequent flyer who elegantly combines her passions for worldwide travel, running a gazillion marathons all over the globe and staying fit ... without sacrificing her fancy for good wine and food.

I’m not so sure. I think I’d rather have the 100K. If you put a very conservative value of 0.7 cents on a point, than the 100K offer is worth $700, less the fee is $605. This new offer gives you a 35K night worth $245, plus a $250 credit, so a $495 value.

Not to mention that the 35K cert is much less flexible than the points – it has a one year expiration date, and 35K hotels are getting harder to find, between category increases and peak pricing, and if you use the cert at an off peak or lower category hotel that costs 25 or 30K , the point different isn’t refunded.

I don’t disagree – I think it depends on how often you stay at Marriott hotels and the level hotel you usually choose. For me, since I only stay at Marriotts sporadically, this is better than fine. Plus, the investment in this card is lower (and the annual fee is waived for the first year).

Yes so the title is very misleading though because it’s a much better offer only specific to you… It’s not an actual much better offer as pointed out above in the comments… I would really recommend editing the title because on paper… Into most people… It’s actually not a better offer at all

I edited it a few hours ago. thank you!