photo: geralt/pixabay

A comparison of two incomparable cards…

It’s been a few months since I applied for a new credit card. I have some expenses and thought this might be a good time to use a new card to meet a spend requirement and boost my points and miles stockpile. For me, I look at credit card bonuses that will translate to extra travel. That’s my thing. Your priorities may be different, and that’s fine too.

As detailed below, the two credit cards on my mind were the Capital One® Spark® Miles for Business and the Chase Ink Business Card. They are entirely different cards. Ideally, I want both of these cards, but realistically, only one is right for me.

The Capital One® Spark® Miles for Business is at the top of many lists right now because there is a limited time whopping 200,000 mile bonus, which is both incredibly awesome and valuable. The catch is you have to spend $50,000 within the first six months, which pretty much knocks me out of the water. But, while this card is not a reality for me, it may be perfect for many small business owners.

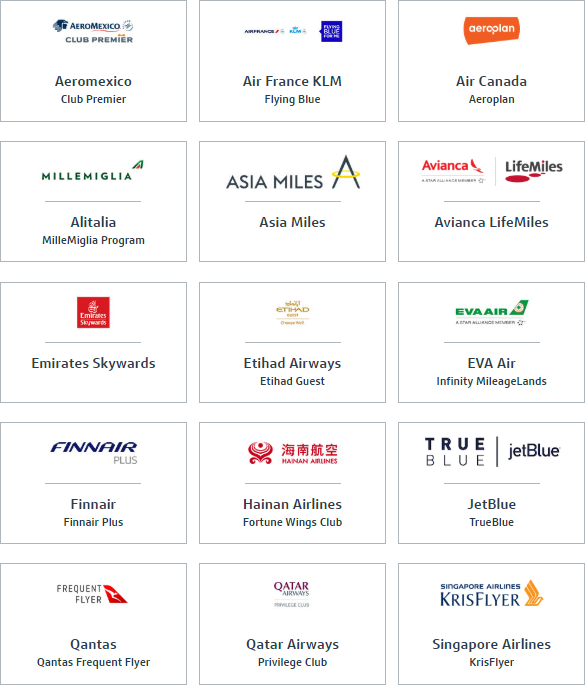

What makes this card particularly attractive is that, separate from the option to use the miles like cash, you can transfer the miles to 15 airlines at various ratios similar to the way you can transfer Ultimate Reward points, Thank You points and Membership Reward points to airlines and hotels. It is this feature that makes this card so worthwhile!

Capital One has 15 Travel Partners

The annual fee is $95 (waived for the first year), you earn 2 miles per dollar on ordinary spend, and 5 miles per dollar for hotels and car rentals. It has other benefits too, such as reimbursement for Global Entry, purchase protection, no foreign transaction fees, and way more. If you have a business and can spend $50,000 in six months, take a good look at this card! You are welcome to read more about this card here. (Bummer that it isn’t a good fit for me).

So, what should I apply for?

CHASE TO THE RESCUE!

I am a big fan of Chase credit cards that offer Ultimate Reward points. I like that I can transfer UR points to airlines such as United Airlines or hotels such as World of Hyatt or use the UR points to pay for flights at 1 UR point per $1.5. On the personal credit card side, I have the Chase Sapphire Reserve (expensive but, for all of the travel benefits, I think it is totally worth the price) and the Chase Freedom card (great for 5X points for quarterly category spends). On the business credit card side, I have the Chase Ink Business Preferred card (great for 5X points for Office supply purchases as well as cable and Internet payments).

What I’m missing is one of the CHASE UNLIMITED cards – there’s one on the personal side (Chase Freedom Unlimited) and one on the business side (Chase Ink Unlimited for Business). Right now the welcome bonus for the business version is better – $500 (which translates to 50,000 Ultimate Reward Points) after a $3,000 spend in three months as opposed to the welcome bonus for the personal card – $150 (which translates to 15,000 Ultimate Reward Points) after a $500 spend in three months. Neither of these cards have an annual fee.

Sheesh, I almost forgot to mention the most important part — the reason I want an UNLIMITED CHASE card is because purchases earn 1.5 UR points per dollar! These cards complement cards such as the Chase Sapphire Reserve, Chase Sapphire Preferred and the Chase Ink Business Preferred, and are useful for purchases that don’t otherwise earn bonus points or miles – i.e., everyday purchases.

You are welcome to read more about the Chase Ink Unlimited for Business card here.

After this analysis, I decided to submit an application for the Chase Ink Unlimited for Business card. I was certain the pesky PENDING – We Need to Review message would pop up on the screen immediately after I hit send, but to my delight I was automatically approved for the card!

That’s a nice way to start the day. Have you applied for any credit cards recently, and if so how did it work out? Do you have a strategy?

A New York frequent flyer who elegantly combines her passions for worldwide travel, running a gazillion marathons all over the globe and staying fit ... without sacrificing her fancy for good wine and food.

A New York frequent flyer who elegantly combines her passions for worldwide travel, running a gazillion marathons all over the globe and staying fit ... without sacrificing her fancy for good wine and food.

I got into credit cards ~2.5 years ago, without knowing the inside bank rules. By the time I found out about the chase 5/24, it was too late. So, this now leaves, but with one choice, Spark Biz.

Ever since I moved a chunk of money to Chase private client,they don’t seem to bother me about 5/24

Sweet!…thx for the tip!