Guest post by Jason Dimaio

Ever have someone tell you that if you spend $50,000 they would give you something you really wanted? Ever spent that $50,000, and have those people give you the wrong thing, and have no idea how to fix it? That’s what’s happened to me today, and as I’m starting to learn, several other customers of American Airlines and Barclays bank.

With a mixture of leisure and business travel, I’ve had status on American Airlines (AA) for the last few years, holding Executive Platinum (EXP) status for the last two. The AAdvantage program, American’s loyalty program, changed to add a revenue requirement last, called Elite Qualifying Dollars (EQDs) last year. This made it more challenging for leisure travelers to maintain status purely by flying, as leisure travelers typically look for the cheapest fare. To maintain EXP status, I had to hit a combination of $12,000 in EQDs, and either 100,000 Elite Qualifying Miles (EQMs), or 120 Elite Qualifying Segments (EQSs, not really germane to this story).

Still, American entered into a partnership with Barclays, which issues two AAdvantage branded Aviator credit cards: Red & Silver. With the Red card, if you spend $25,000 in a calendar year, you will receive a bonus of $3,000 EQDs. After 90 days of holding the card, you can be eligible for a shot at upgrading to the Silver Aviator card. That has bonuses for both EQDs, and Elite Qualifying Miles that can be an additional $3,000 EQDs and 10,000 EQMs, for a max total of $6,000 EQDs and 10,000 EQMs in a calendar year.

If you search the web for how Barclay is supposed to work with the timing of this accrual, any spend made in the calendar year shall have that bonus applied to the same year. As my upgrade to Silver happened very late in the year, in early December, I reached out to both AA and Barclay, both via phone and text, to verify that if I hit my spend in 2017, those bonuses would go into my 2017 AAdvantage earnings. Unequivocally, they said it would, even though the bonus from my Barclay spend may not post to my AAdvantage account until we were in January.

The last week of December, my account page still showed that I was shy in both my EQDs and EQMs, so I reached out to both again to verify, spelling it out very clearly with a lovely woman from AA Customer Service – “My Barclay bonus isn’t posting. If it posts next week, in January, will the bonus put me over the top to get EXP next year.” “That is exactly how it works,” she reassured me.

This morning, I checked my AAdvantage account, the way I have almost every day this month, waiting for the bonus to hit. I’ve only taken one flight so far this year, booked with British Airways Avios, so imagine my surprise to see this:

So, my Barclay bonus for 2017 posted as a 2018 bonus.

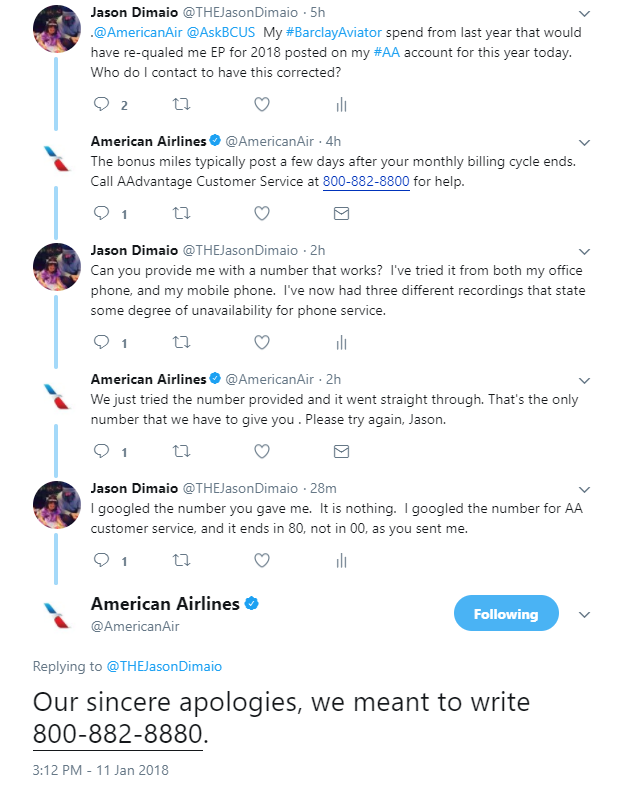

I initially reached out to the Barclay Twitter team, and the American Airlines Twitter team, explaining the issue, and asking them for the appropriate person or department to contact. At first, American gave me a wrong, non-working number. Eventually, I found the correct number, and called in. A perfectly pleasant AA Customer Service agent verified that everything was as I described it, but said he didn’t know how to do anything about it. He put me on hold while he spoke to someone else. He came back to say that he had to escalate the issue, as neither he nor his supervisor had any idea of how to fix it. He also informed me that the fix could take several weeks. When I asked him if that meant that I would drop to Platinum Pro (PP, and the next status tier down) at the beginning of February, he replied that this is exactly what would happen. All of the EXP benefits that I’ve earned would not be accessible to me. He seemed genuinely sympathetic in his powerlessness to mitigate or resolve the issue.

After I got off the phone, I received a few more messages from the AA Twitter team, but nothing that was helpful. At the same time, the Barclays Twitter team asked me to DM them, and they’d escalate the issue right away. Nice, simple, customer service, Barclays!

So, right now, I’m in limbo, but there’s another interesting part – I’ve been conversing with people in EXP groups on social media, and apparently, I’m not alone. There are others that had this happen to them today.

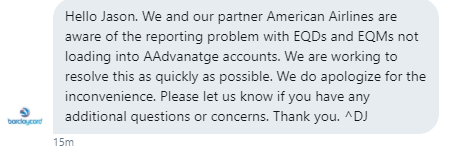

While I was writing this, I received this updated message from Barclays:

We’ll see how this plays out.

A New York frequent flyer who elegantly combines her passions for worldwide travel, running a gazillion marathons all over the globe and staying fit ... without sacrificing her fancy for good wine and food.

A New York frequent flyer who elegantly combines her passions for worldwide travel, running a gazillion marathons all over the globe and staying fit ... without sacrificing her fancy for good wine and food.

Well if they don’t fix it, at least you have the EQDs done for 2018 🙂

That was an upside I was considering. $12k of EQDs possible in a calendar year? Could have been interesting to explore.

Yeah, but I don’t find getting $12K of EQDs awarded to be that useful, as chances are, you’d end up running up around at least $6K of EQDs on the way to chasing 100K EQMs.

Even if you did LAX-HKG-LAX 7 times to get the EQMs at $370 EQDs per trip, you’d still run up $2800 of EQDs.

The other trick is partner flights, a lot of fares have a 5:1 EQM:EQD ratio (50% EQM, 10% EQD) and a lot of premium fares have a similar ratio (150% EQM, 20% EQD). I’ve found these fares to give me a disproportionate number of EQDs which let me blow through the EQDs well before hitting the EQMs to make EXP.